2009 Real Estate Market Update … as the year closes

Some of this article comes from Keller Williams Research and the data comes from the National Association of Realtors, Freddie Mac, The Wall Street Journal, The Washington Post and KW Research. Take a look and let me know if you have questions or want to talk about what you see.

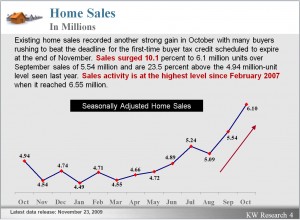

Small steps to economic recovery continued last month. Among the positive readings was the report of a third quarter GDP growth rate of 2.8 percent, which followed four consecutive quarterly declines. This advance comes in well ahead of that of our Canadian neighbors, whose economy was once anticipated to be the first country out of recession, and by significant margin. Canada posted marginal 0.4 percent growth. Unemployment fell in November for the first time since April 2008. A strong rebound in home sales activity from year ago levels also points to a firmer stabilization.

With the extension of the $8,000 federal housing tax credit into spring 2010, first-time buyers will now have an additional few months to purchase their dream homes. Expansion of the income restrictions now gives possibilities for higher earners to participate too. And the $6,500 tax credit now available to established homeowners with five consecutive years or more in their homes broadens the opportunity landscape. This in turn will allow the housing market more time to find a more solid footing on a sustainable recovery.

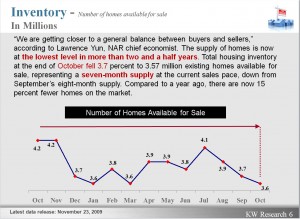

This chart shows how inventory is falling consistent with the increase in sales. We are getting closer to a balanced market (6 months of inventory) and that will help with that solid footing. Foreclosures are increasing but new construction is almost non-existent so overall desirable inventory is falling.

Although economists continue to debate the overall shape of the recovery, it is widely agreed that the U.S. economy will take a long time to rebound. Unemployment is expected to remain high for several quarters and the number of underemployed is expected by some economists to remain a drag on growth prospects. On the brighter side, according to some economists, a slow and steady growth will likely fair better for the long-term well-being of the economy. Slower, sustained growth can help prevent dangerous asset bubbles, like the recent housing and technology bubbles, from growing and bursting.

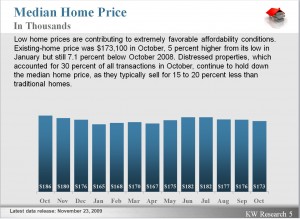

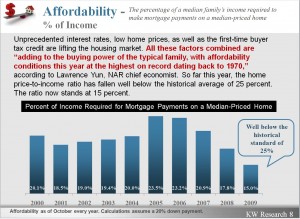

The median home price is holding fairly stable. This combined with lower interest rates are making homes affordable for more people. We are currently holding at about 15% affordability which is the lowest on record since 1970.

Now armed with all this data what do you do?

If you are a seller who wants to move I would suggest a couple of things. First, get your house on the market today (no later than the first week of January) if you want to capture all the buyers that will be hitting the market after the holidays. We have had a fairly hot market but it has stalled for the holiday season. That will come to an end almost immediately. Second, have your house in top condition and priced to the market. Buyers are still looking for a deal and will bypass a house that is over priced. The driving force in this market will continue to be appraisal values so pay attention closely to the current market data.

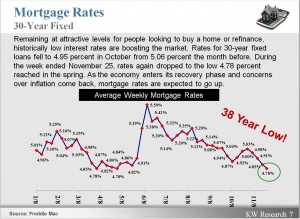

If you are a buyer ready to make that purchase then get busy looking right now. Use this search engine for the most current data. Inventory is falling and desirable homes move fast if they are priced right. The extended tax credit for 1st time buyers will keep the activity up for some time to come but you have to be a qualified buyer. Call your lender (or me if you don’t have a lender) and get that pre-approval letter in hand. Not just a pre-qualification letter but a pre-approval and if your credit score or income to debt ratio is marginal you need to move NOW. Fannie Mae guidelines will be changing to require a higher credit score (580 to 620) and FHA will be looking for more down payment (3.5% to 5%) soon so you could be left behind if you don’t get moving. FHA is making more changes to manage risk by increasing the down payment, higher mortgage insurance premiums and lower seller concessions but there is no time table on that yet.

If you are selling and buying then the strategy is to price your house at the market value and be willing to give on the sale so that you are positioned to make it up on the purchase. Most sellers that have been in their house for a while will qualify for the new tax credit of $6500 in the move but it expires in April 2010. Not much time to get this done. Check with you tax professional to be sure you qualify but don’t wait too long.

PS. If this all sounds overwhelming then take a deep breath, get a cup of coffee and call me. My goal is not to scare you or give you a feeling of panic but to let you know what is happening as best I can. If you made it this far in the article then you are obviously interested in finding out what is happening and I can’t include everything here. I am ready to help and because I work by referral I have the time to help you when you need me.

If you know someone who is even thinking about buying (or selling) please call me with their name and number. I am NEVER too busy for your referrals and we will take great care of them.

One last thing, I am starting a new effort to reach people in trouble with their homes. 57% of all home owners that go into foreclosure never contact the lender because they are ashamed or scared. Check out www.CarrierOfHome.com for more info of how we can help.

Thanks for listening,

Jerry Robertson

678-231-1578