What Do You Really Need to Qualify for a Mortgage?

A recent survey by Ipsos found that the American public is still somewhat confused about what is actually necessary to qualify for a home mortgage loan in today’s housing market. The study pointed out two major misconceptions that we want to address today.

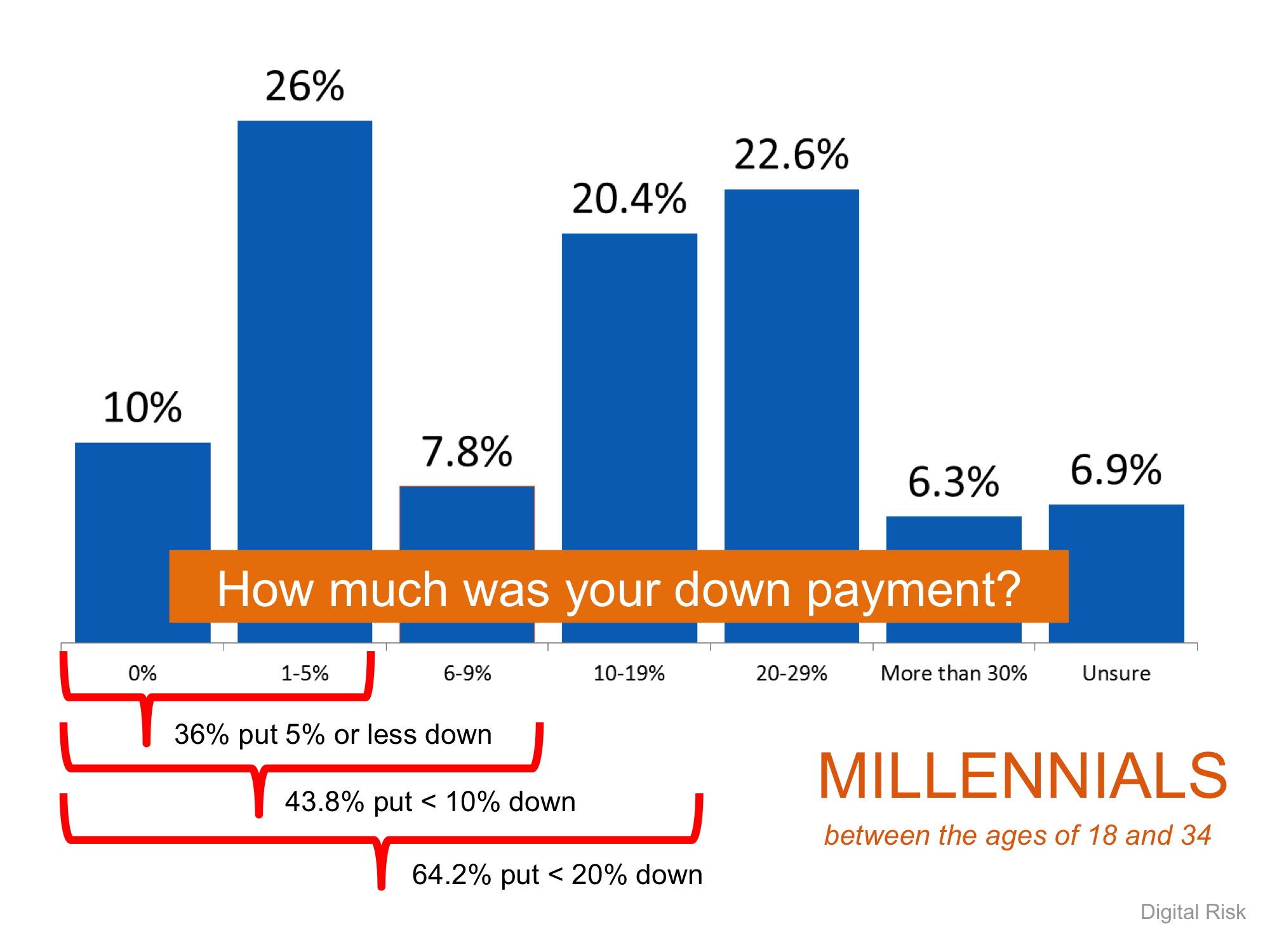

1. Down Payment

The survey revealed that consumers overestimate the down payment funds needed to qualify for a home loan. According to the report, 36% think a 20% down payment is always required. In actuality, there are many loans written with a down payment of 3% or less.

Here are the results from a Digital Risk survey done on Millennials:

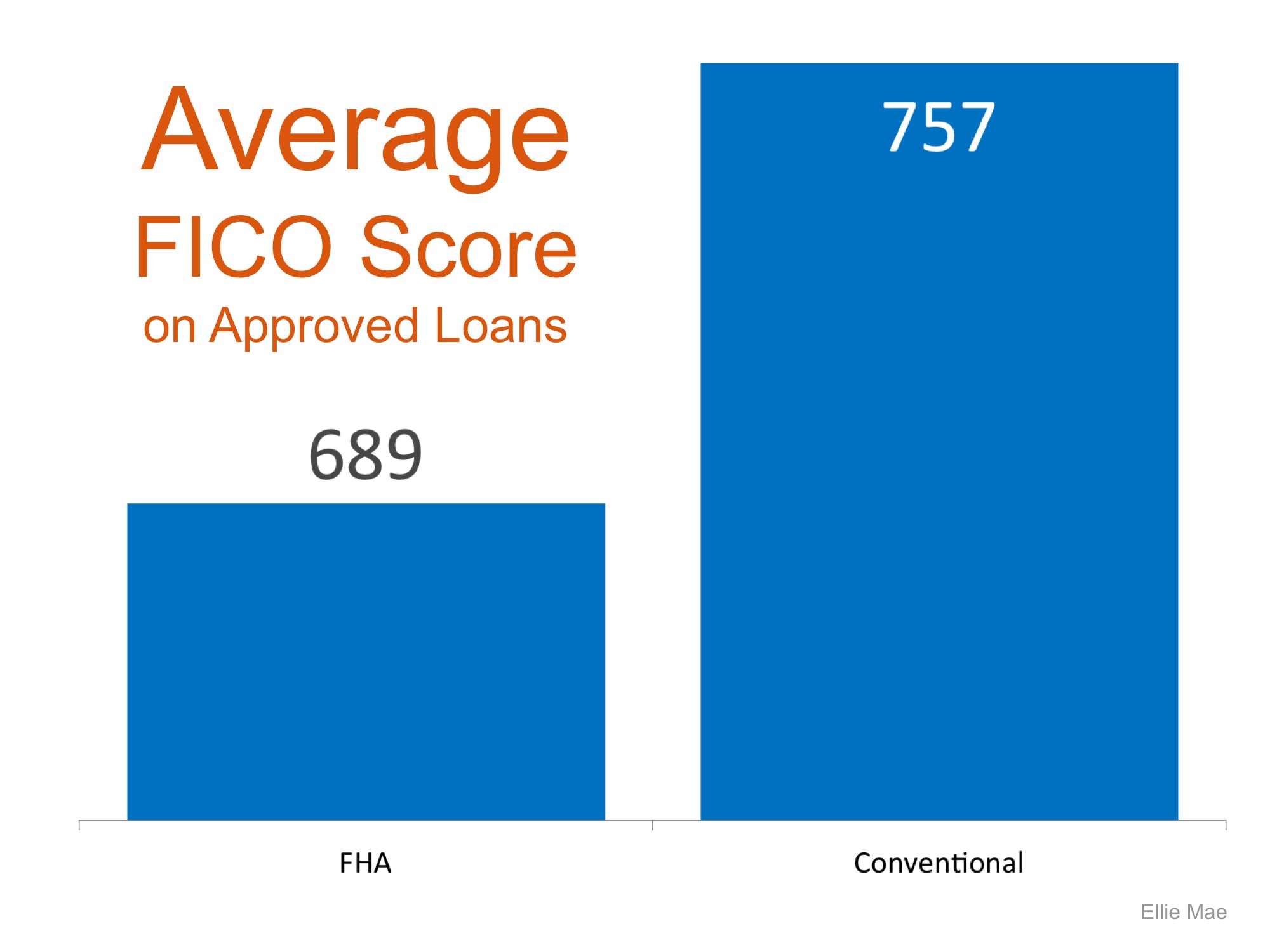

2. FICO Scores

The Ipsos survey also reported that two-thirds of the respondents believe they need a very good credit score to buy a home, with 45 percent thinking a “good credit score” is over 780. In actuality, the average FICO scores of approved conventional and FHA mortgages are much lower.

Here are the numbers from a recent Ellie Mae report:

Bottom Line

If you are a prospective purchaser who is ‘ready’ and ‘willing’ to buy but not sure if you are also ‘able’, let’s get together to discuss your true options.

Source: Keeping Current Matters

- Thinking of Buying a Home? Ask Yourself These 3 Questions!

- 3 Graphs That Scream List Your House Today!