The glass is too big…

I am a recovering engineer. If you know me you know that to be true. In the old question about seeing glass half full or half empty. Optimists see it half full, pessimists (or realists) see it half empty. Engineers just see a glass that is too big.

I am asked every day ‘How’s the market” or “Are you OK?” or “is it ever going to be like it used to be?” or “When do you think the value of my house will be what it was?”. Lots of questions. My best answers come from data and a good look at the market.

First of all, the market is good. It is the best time to buy a house ever. Prices are pretty stable to maybe rising in some areas, interest rates are at all time lows. I will say it again, ALL TIME LOWS. Never has it been as good as it is right now for interest rates. They are not very likely to go down more but it is highly likely that they will go up.

It is probably less expensive to buy than rent for most people reading this. If you are renting you need to call me and we’ll talk 🙂 but I digress. I want to show you some data that can put this in perspective.

First is a chart that shows what home prices have done and what they should have done over the last few years if the government and other forces had not tinkered with it. This info comes from a speech our co-founder Gary Keller gave at our KW Family Reunion in Orlando just a week ago.

Click on it if you need bigger version to look at. You will see that we have an historic curve of 4% appreciation in the US. If we had left things alone we would have avoided the ‘bubble’ in the 2000’s and would have been about $219K for the average sale price. But we did not do that. Notice that right now we are about 24% below that level in our home prices with a lot of that to blame on over building and artificial pricing due to irrational investing. Check out the next chart.

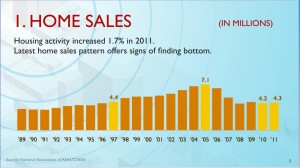

In 2005 we sold 7.1 million homes. That is about 2 million more than we needed to meet our demand for housing due to population growth, normal investing and destruction of older homes to make way for new. We kept building for a while after that but it tapered off as builders stopped being able to sell them. At one time about 40% of all foreclosures were not owner occupied. Investors buying with the hope of making a quick profit. Too many, too fast and here we are. It’s complicated and we could discuss the details but this is a quick picture of what happened.

So what.

In a nutshell, this shows we are at or near the bottom of the market (prices have stabilized), inventory is down from a peak of 10.4 months to a balanced market level of 6.2 months nationally (we are lower than that locally) and interest rates are really low. I believe that we are in for a delay in the prices coming back up significantly but that works to your advantage because I see them coming back to the 4% curve and appreciating at a higher than normal rate once the unemployment number improves.

I have lots more charts but that is enough for tonight. If you want to chat about the details and see more info on this just call me and we’ll get lunch or coffee. If you are thinking of buying it is time to get in. If you need to sell I can let you know what your house is worth now and see if it makes sense to sell and take advantage of the buyers market to get the next house you want on sale. I am taking new listings right now.

If I told you that the new BMW convertibles were discounted 24% and I could help you get one tomorrow, would you call me? I suspect you would. Well, what are you waiting for if you need to buy a house. They are discounted 24%!!

Thanks for listening,

Jerry Robertson

678-231-1578 Cell